How Financial Services Providers Can Increase Insights ROI

Consumer trust in banks has been falling, and in the last 2 years, that trend has accelerated. A study conducted by Accenture with 47,000 banking customers across 28 markets found that just 29% trusted their banks to look after their long-term financial wellbeing, down from 43% 2 years ago.

On top of this, new competitors are emerging constantly. FinTech disruptors like Klarna and Revolut are finding innovative ways to meet consumer needs, raising the stakes for all financial services providers when it comes to successful, consumer-centric innovation.

However, the outlook is far from being all doom and gloom; financial services providers have a lot of the resources they need to truly connect with their customers. It’s just a matter of using those resources effectively.

Why your insights ROI is lower than it should be

While the desire to be consumer or customer-centric is widespread across industries, many companies find it challenging to transform insights into action.

That’s because like any organizational initiative, it’s a team effort. Depending on the company, it requires dozens, if not hundreds (or thousands) of employees to make decisions centered around the needs and wants of their customers.

A central challenge to achieving this level of customer centricity is ensuring that employees across the organization have access to the customer insights they need.

But this shouldn’t come as a surprise. Many companies, including financial services providers, lack the right technology to support these efforts. And without the right technology, valuable customer insights go to waste.

Here are 3 common reasons that your insights aren’t generating as much value as they could be.

Reason #1: Research gets lost.

Sometimes it’s just this simple; research gets lost. Without a dedicated solution for storing insights, reports get tucked away on local hard drives, buried in inboxes, or abandoned in a maze of file drive folders. This can especially be a problem for large, decentralized companies, companies who have recently merged, or companies with high rates of employee turnover.

Research lost is money lost. Depending on the size of the study, market research and customer insights can cost thousands of dollars (if not more). So when research goes missing, the loss of value is two-fold. The initial investment isn't recovered and the opportunity to create returns on that investment also goes out the window.

What’s more, missing or hard-to-find research creates additional costs because employees spend time trying to find it. For example, the median salary for a consumer insights manager in the US is $123,501/year. Now consider that research from McKinsey has found that knowledge workers spend 19% of their time each week searching for and gathering information. So let's do the math.

Assuming that median salary, time spent searching for and gathering information costs roughly $23,465 in a year for one insights manager. But few insights teams are just one person; for a team of 5 insights managers, that figure easily exceeds $117,300 worth of wasted hours every year on the team level. Factor in time that other stakeholders, like marketing, brand, or product managers spend looking for information, and that number gets even larger.

Reason #2: Research doesn’t get to the right people at the right time.

Sometimes the problem isn’t that research gets lost, but rather that it doesn’t get to the right people at the right time. When this happens, the underlying issue can usually be attributed to knowledge silos or information overload.

With knowledge silos, information is shared too slowly or not at all. For example, perhaps a key insight about changes in consumer saving behaviors doesn’t reach relevant stakeholders until it’s too late to revisit previous stages of a project. Or perhaps another team in a similar market tested the same idea and found it didn’t work–which could have saved everyone a lot of time and effort if only they had known.

In the case of information overload, too much information is being shared, making it hard to sort through what is or isn’t important. So even if relevant insights are getting to the right people, they aren’t being absorbed. In fact, in the U.S. economy alone, analysis has suggested that information overload costs over $900 billion in lost productivity and innovation.

What both of these problems have in common, however, is that they both result in insights not getting applied. So even if insights aren’t truly lost, they aren't being factored into decision-making, where they are able to actually generate value.

Reason #3: Ineffective solutions waste resources.

Another reason that valuable insights go to waste are ineffective knowledge management systems. Whether it’s a DIY system (like SharePoint or Google Drive) or a specialized tool with sub-par user experience, these ineffective solutions can end up costing more than doing nothing at all.

The workload of set-up and maintenance can drain both time and financial resources. These are resources that could otherwise be spent on tasks like brainstorming or commissioning fresh research.

And then comes the problem of poor user experience. If a tool is challenging or annoying to use, it’s likely going to result in low user adoption. For example, tagging and naming files so that they are searchable might prove too tedious, so uploading new reports slowly creeps to the bottom of to-do lists. Until it stops happening at all.

The bottom line is that investing in a platform that no one uses means you’re just paying to have the same problems with insights underuse that you had before (and then some).

The right technology can make all the difference

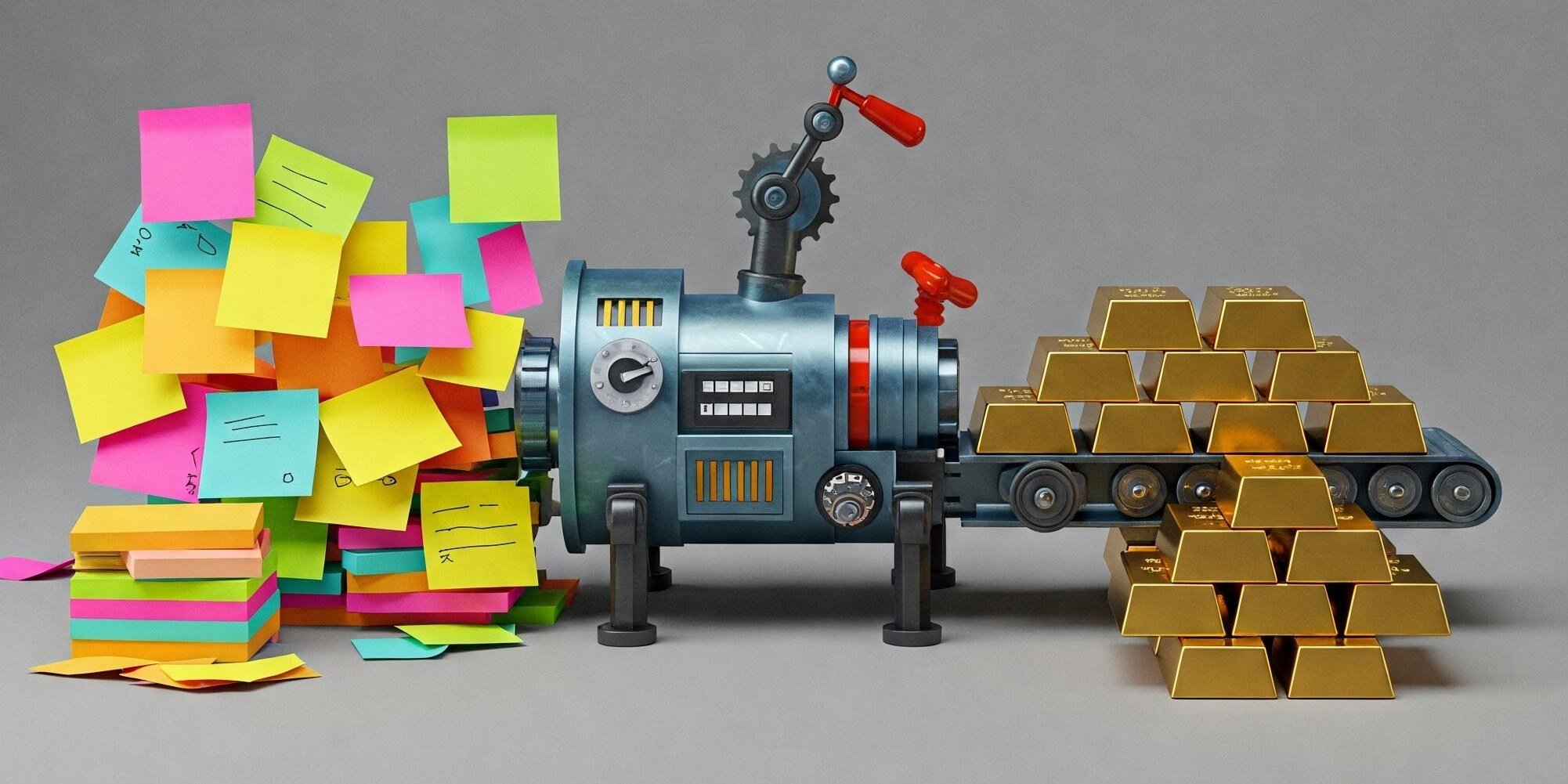

Customer insights are business assets that need to be cared for, just like machines, robots, or production lines.

But without the right technology, it can be challenging to ensure that relevant insights are readily accessible. And in order for customer insights to create value, they need to be applied and transformed into action.

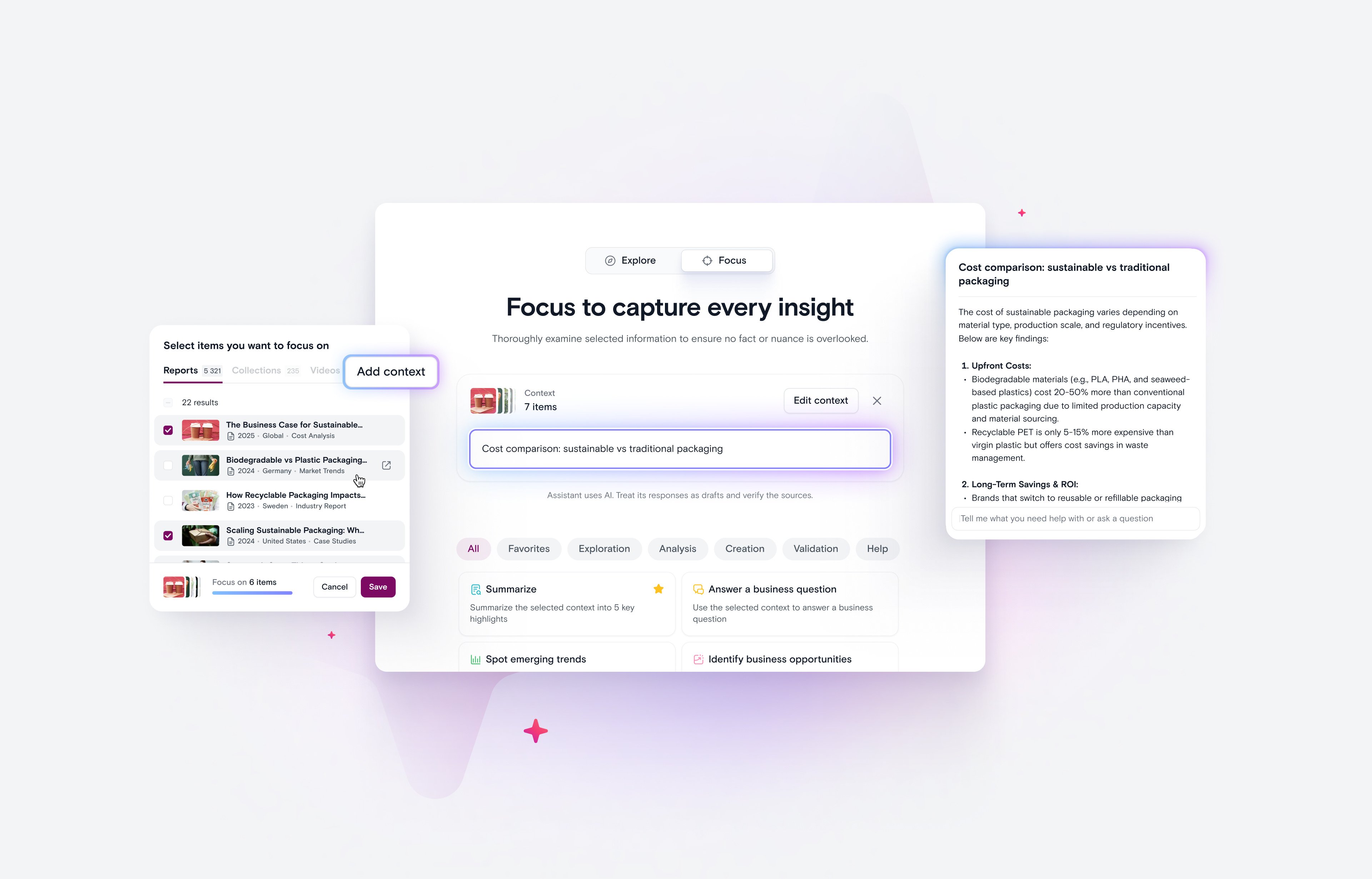

Investing in a powerful, user-friendly insights platform is a great way to ensure that insights are easy to access, share, and apply.

By addressing these common reasons that customer insights go to waste, banks and other financial services providers can better understand the needs of their customers, enhancing trust and increasing opportunities for value creation.

Related Content

Stravito Enhances GenAI Assistant to Accelerate Time-to-Insight

Charlotte Hilton Mar 20, 2025